You have to only type name or few. You can use 4 digit HS code to generate your invoices.

How To Pay Business Taxes In Canada

Goods and services tax GST is added to the price of most products and services.

. The income tax in Singapore is subdivided into the corporate income tax applicable for businesses and personal income tax for private persons. Under this tax slab 12 tax is levied on the goods and services we use. Goods and services tax GST is a broad-based tax of 10 on most goods services and other items sold or consumed in Australia.

Sales of goods and services in the course of your business or enterprise ie trading stock. GST Code Detailed Reference Guide 31 Supplies SalesIncome - Summary of Transactions and GST Impacts The GST treatment GST Code will depend on the type of supply made as outlined below. Goods Services Tax GST Payment.

GST exemptions apply to the provision of most financial services the supply of digital. 14 rows The following table provides the GST and HST provincial rates since July 1 2010. In other countries GST is known as the Value-Added Tax or VAT.

The rate you will charge depends on different factors see. Some things dont have GST included these are called GST-free sales. Where the supply is made learn about the place of supply rules.

You can also charge GST 15 on what you sell this is collecting it on the governments behalf. You can search GST tax rate for all products in this search box. Gst Hourly Pay Rate How much do Gst employees Hourly make in the United States.

Customs and excise duty. ThinkStock Photos Although the GST charged on such supplies can be claimed as input tax credit ITC companies which are exempt from GST will not be able to claim credit. In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed.

HS Code is internationally accepted format of coding to describe a product. Under this tax slab 18 tax is levied on the goods and services we use. Base Salary USD 79211 year hour.

Whether GST also covers salary and remuneration to employees within its ambit. What is HS Code. Goods and Services Tax or GST is a broad-based consumption tax levied on the import of goods collected by Singapore Customs as well as nearly all supplies of goods and services in Singapore.

View Hourly Rate. Gst pays an average salary of 79211 and salaries range from a low of 68932 to a high of 90787. Here you can search HS Code of all products we have curated list of available HS code with GST website.

Will be July 2020. Individual pay rates will of course vary depending on the job department location as well as the individual skills and education of each employee. Under this tax slab 0 tax is levied on the goods or services we use.

Lease or develop you may have to pay GST on the sale or lease of the property. Goods and services having 18 12 5 GST slab rates came down to Nil for many of the products. 100 rows The GST rates are fixed under 5 slabs NIL.

For example if one calculates their salary income tax for the fiscal year 2019-20 their assessment year will be 2020-21 and the last date for Income Tax efiling their ITR. All around the world same HS codes are used to discribe a product. The procedure to find HS Code with tax rate is very simple.

Type of supply learn about what supplies are taxable or not. Attend our GST webinar to help you to understand GST and its implications for business. Goods and Services Tax.

Who the supply is made to to learn about who may not pay the GSTHST. Find GST HSN Codes with Tax Rates. Betting and casino taxes.

Salary for services like accounting IT human resource provided by the head office of a company to its branch offices in other states will attract 18 per cent GST. GST Tax Rates revisions Revision all big recent revisions 28 th GST Council meeting held on July 21 st 2018 came up with number of revisions regarding the GST slab rateThis included GST rates deductions on 28 slabs which came down to 18 and 12. GST rates for all HS codes.

Individual salaries will of course vary depending on the job department location as well as the individual skills and education of each employee. Under this tax slab 5 tax is levied on the goods and services we use. Goods and Services Tax GST.

The GST amount on property sales may be calculated on the full value of the sale or on the margin for the sale. Gst pays an average hourly rate of 38 and hourly wages range from a low of 33 to a high of 44. If youre GST registered you can claim back the GST you pay on goods or services you buy for your business.

The main taxes of the taxation code in Singapore are as follows. 12570 is the standard Personal Allowance in 2022 but the figure does change.

How To Pay Business Taxes In Canada

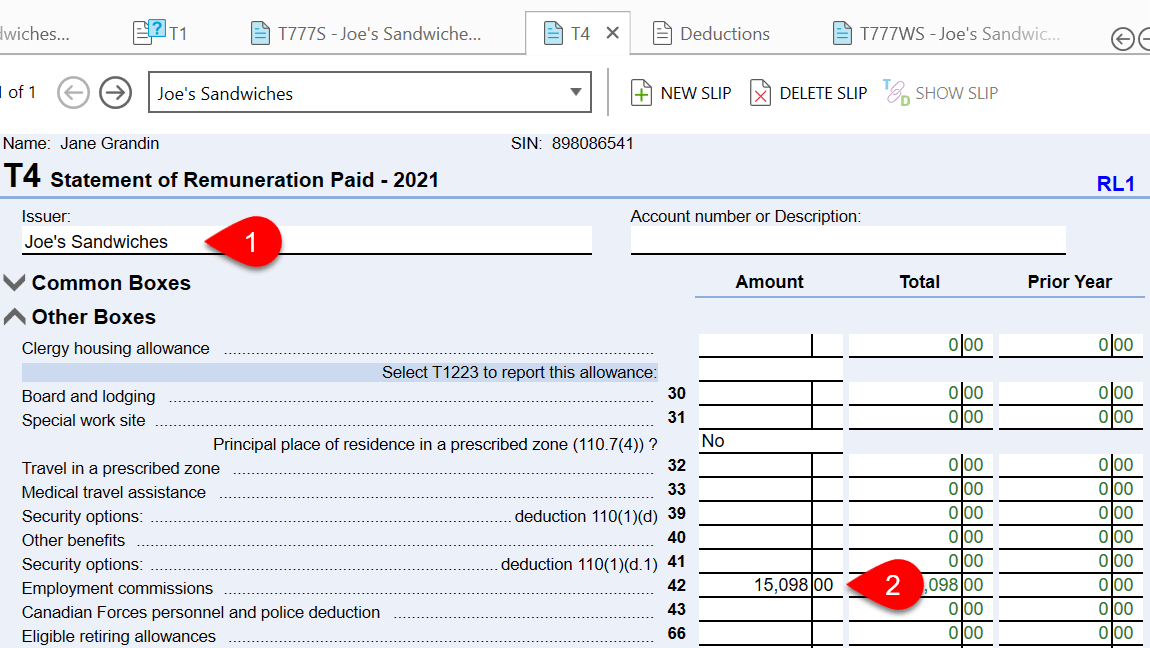

Employment Expenses T777 Taxcycle

General Accountant Resume Template Premium Resume Samples Example Accountant Resume Resume Template Resume Examples

Gst Hst Zero Rated Exempt Supplies Canadian Tax Lawyer S Guide

How To Pay Business Taxes In Canada

Awesome Property Management Work Order Template

Aiat Gst Suvidha Kendra Income Tax Return Income Tax Return Filing Income Tax

What Is The Difference Between Gst And Income Tax Quora

Aiat Gst Suvidha Kendra Income Tax Return Income Tax Return Filing Income Tax

Must Know Important Things On Gst Payment For Freelancers Freelance Goods And Service Tax Payment

Watch This Video Here Http Www Youtube Com Watch V Wsvfcomdrcq Fast Track Income Salary

How To Pay Business Taxes In Canada

Payslip Template Free Word Templates

Tax Taxaudit Gst Lastdate Incometax Penalties Refund Returns Income Tax Capital Gain Business Law

How To Pay Business Taxes In Canada